“There will be a surprise in there somewhere,” they said on the morning of the Budget.

But they were wrong. This was a “Budget of few surprises for small businesses,” according to the NFRN. The FSB tweeted that it was ‘steady-as-you-go’ for small businesses.

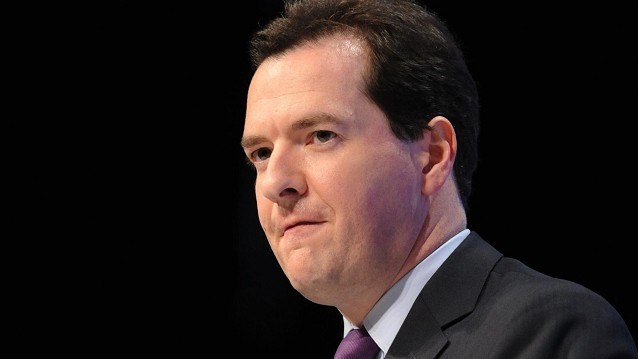

So what are we to make of it? Could, or should, George Osborne have announced more support measures for small businesses?

The ongoing problems of illicit trade in alcohol and tobacco were alluded to, but was the promise of “a view to legislating [on tobacco smuggling] in 2015” enough?

Budget nuggets:

- ALCOHOL: duty escalator scrapped. Duty frozen on spirits and ‘ordinary’ cider. Beer duty cut by 2%

- TOBACCO: duty escalator continues at 2%, which will widen the price gap between legal and illicit product, boosting smuggling

- INVESTMENT: Annual Investment Allowance doubled to £500,000 from April 2014 until end of 2015

- ENERGY: retailers will benefit from more transparent agreements with energy suppliers – particularly contract end dates

- BUSINESS RATES: confirmation there will be £1,000 rates discounts for two years for businesses with rateable values of up to £50,000, but no mention of fundamental reform

In some senses it was a Budget of two halves, with alcohol the winner and tobacco the loser. The alcohol duty escalator was binned by the Chancellor, meaning that duty on wine will go up only in line with inflation, while there was even better news for cider and spirits, which have had duty frozen, and beer enjoyed a 2% drop in duty.

If nothing else this is certain to alleviate some of the pressure that legitimate shops are facing from the black market in booze.

Andrew Cowan, country director for spirits producer Diageo Great Britain, said: “The Chancellor has today given a huge boost to one of Britain’s most successful industries. In freeing the industry from a debilitating tax policy the Government has given a show of support for these quality products.”

Meanwhile, tobacco did not escape the expected 2% duty rise, which is an added pressure on the retail industry, especially with a whole host of legislation issues on the horizon such as the tobacco display ban, due for small shops 12 months from now, and the possibility that plain packaging could be introduced at some stage.

Daniel Torras, managing director of JTI in the UK, said: “With the Government set to ban smaller rolling tobacco and cigarette packs and threatening to make counterfeiting cheaper and easier by introducing plain packaging, now is not the time to add a significant tax increase which will widen the price between legitimate and illegal products.

“At a time when the Government is making it harder to fake a £1 coin, it could be about to provide criminals an invitation to further profit from fake cigarettes”.

Comments

This article doesn't have any comments yet, be the first!