Shop owners have expressed solidarity with protesting farmers who took to the streets on 19 November over planned agricultural inheritance tax changes.

Jonathan James, both an operator of dozens of convenience stores and a farmer was one of an estimated 20,000 people who marched through London. He commented: “I’ve never protested in my life but today was different. Behind every family farm is a family and the government today got reminded of that. Proud to take part.”

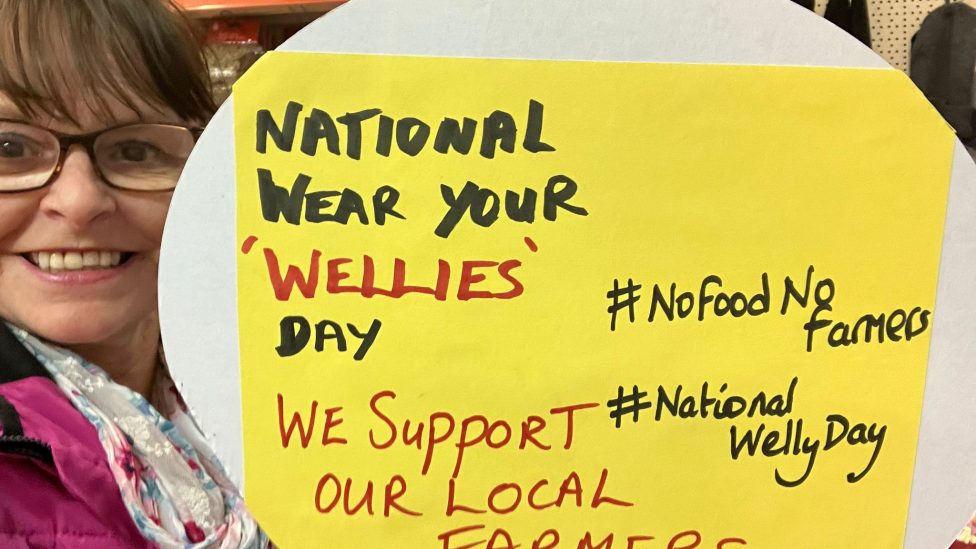

Trudy Davies, of Woosnam & Davies News in Llanidloes in Powys used a display in store to show her support (pictured). The shop owner told Better Retailing: “I am from a farming family. Both my parents and all my uncles, aunties and cousins are in the farming environment. So it’s very close to the heart of our daily life and community. Rural communities, farms and our rural high streets are all integrated. Our store sells produce from local farmers, with some of them being relations of mine.

“All small businesses need to support each other. Especially in these economical strains facing the country at the moment.”

Former ACS chair and former CEO of the My Local convenience store chain Mike Greene also attended the march in London. He said: “[Farmers] work tirelessly to keep food on our tables often going without to ensure that they can pass their farms from generation to generation – unlike entrepreneurs that may exit or cash out a business, which would trigger a taxable gain, these farmers are literally taxed on their death so that their children pay with land on the death of their parents.”

What are the proposed changes to inheritance tax?

Under the changes proposed by Labour, from April 2026 those inheriting agricultural assets worth more than £1m will no longer be exempt from inheritance tax and will pay 20% on assets inherited above £1m. This represents half the normal rate of inheritance tax.

Further allowances mean farmers who are married or in a civil partnership can pass on a farm valued at up to £3m tax free.

The impact is heavily contested. Labour claimed only 500 large farms will be affected each year. Conversely the Country Land and Business Association claimed 70,000 UK farms could be affected overall.

However, not all shops were behind the farmers. Former Big Brother contestant Narinder Kaur has worked in her family’s Newcastle store for 40 years. She claimed it is supermarkets that are destroying small farms and small shops too. She added that all businesses should be subject to the same taxes. Kaur highlighted that like farmers, independent shop owners often pass on their businesses to the next generation but do not expect or receive full inheritance tax relief.

Read more politics news and articles for retailers

Comments

This article doesn't have any comments yet, be the first!