Over the Atlantic in the US there is a war going on over free-to-air television channels. This war offers a useful perspective on your battle to win the purse of local shoppers.

In America 90 per cent of people pay for cable television, yet 96 of the top 100 shows are broadcast by the big four free-to-air networks. People watch these either by having an aerial on top of their television or by getting the channels bundled into their cable deal.

The big four networks thrive on large audiences, which drive their advertising revenues. At some time in the past decade they started to charge cable channels for carrying their content, which produced a great new revenue stream worth billions.

However, someone then came up with a brilliant idea to rent television viewers a small aerial for a fee that undercut the cable companies but also sidestepped the need to pay fees to the big four. While this is only available in New York at present, it has already attracted a series of legal challenges from the big four. They claim the company, Aereo, is stealing their content.

However, someone then came up with a brilliant idea to rent television viewers a small aerial for a fee that undercut the cable companies but also sidestepped the need to pay fees to the big four. While this is only available in New York at present, it has already attracted a series of legal challenges from the big four. They claim the company, Aereo, is stealing their content.

But Aereo has won in the courts. It says all it is doing is renting out aerials to consumers so they can get the free-to-air channels on the devices that they want, record to view on-demand and so on.

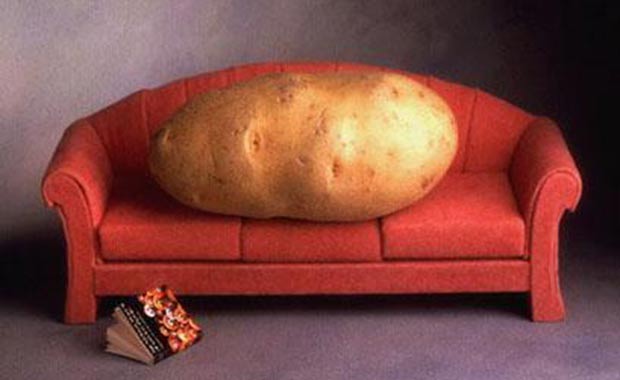

This is a story about audience inertia and the strength of brands. Viewers buy into the big four networks. But if someone finds a better way of delivering the service, they will happily sign on.

So it is with shoppers – their habits and their support of big retail brands, and also their willingness to accept innovations that improve their lives.

This is what is going on in the grocery channel today, where large hypermarkets are suddenly less attractive to shoppers. Instead, they buy big-ticket items through the internet and switch to smaller, more frequent and more localised shopping trips.

The supermarkets are responding to this challenge. Like the big four networks in the US, they fear that a revenue stream could be taken away from them.

However, are local shopkeepers in a place where they can offer the consumer a better deal? While standards have improved and there are lots of positive noises about the independent channel, particularly where symbol stores are concerned, are they good enough?

One major supplier to the convenience market posed the following question to me: if you put a good independent next to a Spar next to a Tesco Express, where is the shopper most likely to go?

He believes Tesco is going to take the major slice of revenue because shoppers are likely to buy into the brand, which means simply they will trust the value Tesco offers more.

Proving him wrong will involve a step-change in the quality of the average independent. If that appeals to you, then you are in the right trade. But don’t expect the supermarkets to make it easy for you at any time

Comments

This article doesn't have any comments yet, be the first!