Rhino Media Group has admitted that it has failed to secure the funding it needed to avoid entering administration.

A message to stores that had worked with the digital screen advertising firm said that “more than 90%” of its retailers no longer want to work with the firm. It added that many had instead begun working with rival providers.

To secure funding, the company said it needed at least one thousand stores to continue working with it, but only secured 153. “RMG cannot secure funding based on these above numbers… RMG has now creditors forcing a petition for liquidation,” the letter stated.

The unsigned message continued: “This is a very sad situation, it has made me feel very depressed, and I am sure those customers that did want to continue on will also feel very saddened reading this update.”

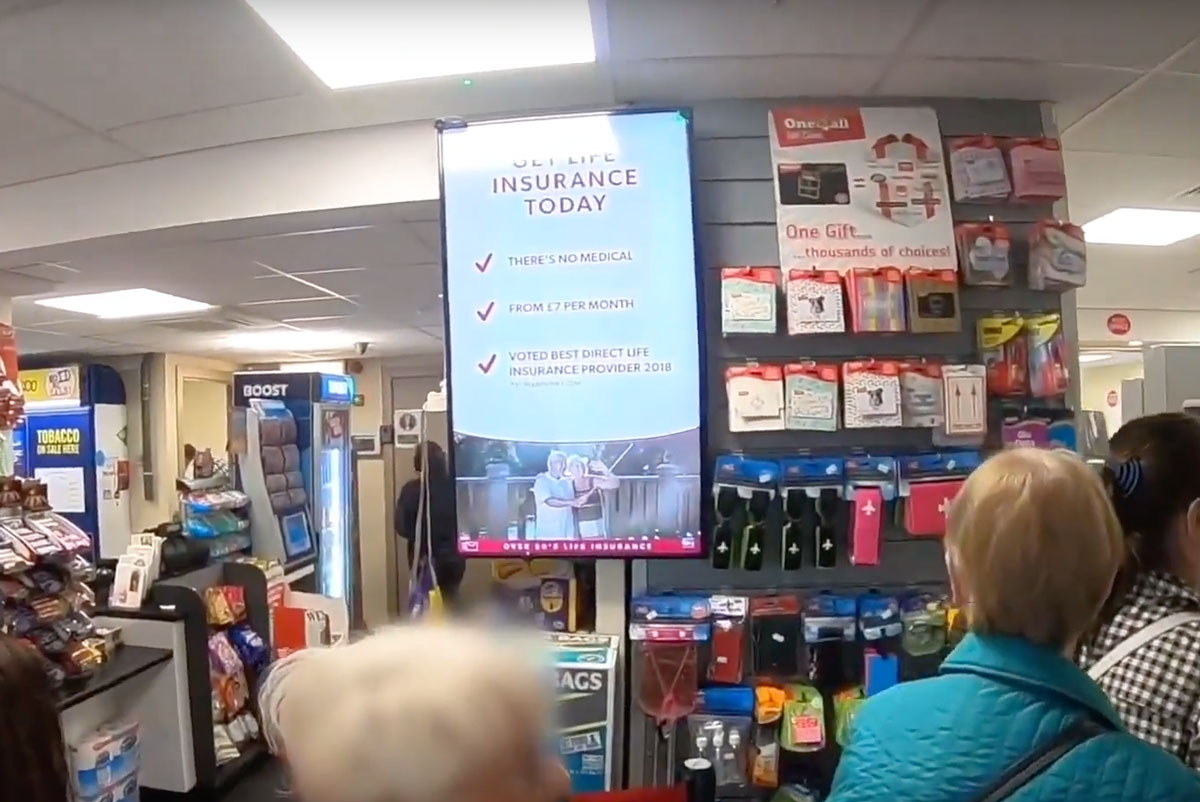

In autumn last year Rhino Media Group defaulted on promised advertising payments for stores that offset loans on in-store digital media displays. Stores were forced by some finance firms to continue repaying the loans, worth approximately £10,000 per screen.

A spokesperson from Rhino Media Group told BetterRetailing in early December that an insolvency practitioner had given it 90 days to secure funding or face potential liquidation. Trading standards and the Financial Conduct Authority were understood to be investigating the nature of the agreements made to retailers.

More than 200 retailers affected by the collapse of Rhino Media and its precursor, Viewble Media attended a meeting in Belfast earlier this month. They discussed potential legal action, supported by trade group Retail NI, against finance companies such as UCFS and Grenke that continue to demand the associated loan repayments despite retailers no longer receiving the services they paid for. Both firms deny that retailers were miss-sold the contracts.

Comments

This article doesn't have any comments yet, be the first!