A strong category for stores

Baby and toddler care products remain strong sellers in convenience stores, as timestrapped parents continue to shop locally. Some grocery categories have declined dramatically in convenience stores since the peaks of the lockdowns, but the baby and toddler care category is holding steady, with sales to October only slightly down on 2020, according to Matt Stanton, head of category & insight at DCS Group, which distributes household, health, beauty, baby and healthiersnacking brands.

The category is down overall by 9.4% annually in the independent convenience channel. Baby-feeding is down by 3.4%, and babycare – nappies, wipes and toiletries – barely at all, down 1.1%. Stanton says the main reason for the slight decline is the falling birth rate. There are a number of factors, one being uncertainty for non-UK families since the Brexit vote in 2016. Breastfeeding is driving the decline in demand for formula baby milk. Parents are also starting to wean earlier from baby milk to alternatives such as cow’s milk. Three key facts retailers need to remember are: young families spend 38% more than the average shopper; 62% of babycare shoppers will shop elsewhere if they can’t find the brand or product they’re looking for; and 86% of babycare shoppers plan their missions in advance.

Getting stock

Any drops in sales aren’t necessarily all due to shopping habits shifting, however. Wholesalers’ stock availability and delivery charges could be putting some retailers off backing the category. Paresh Vyas, from Limehurst Mini Market in Ashtonunder- Lyne, says stock availability is currently a problem for his store.

Vyas says: “Booker’s availability on babycare is bad. It’s got worse since Tesco took over.” Since Booker implemented its £30 delivery charge in February, Vyas has cut his orders to two deliveries a week. Availability is also a problem with his other wholesaler, Parfetts, so he’s looking at buying directly from manufacturers.

Despite his frustrations, however, Vyas remains committed to the category, having built up a strong range of products that continue to bring in consistent profi ts. “The difference between this store and the supermarkets is we go the extra mile,” he says. “We have a three-anda- half-feet-wide babycare section, with everything in one place, which is doing much better than it was two years ago.”

Back to work, back to baby food

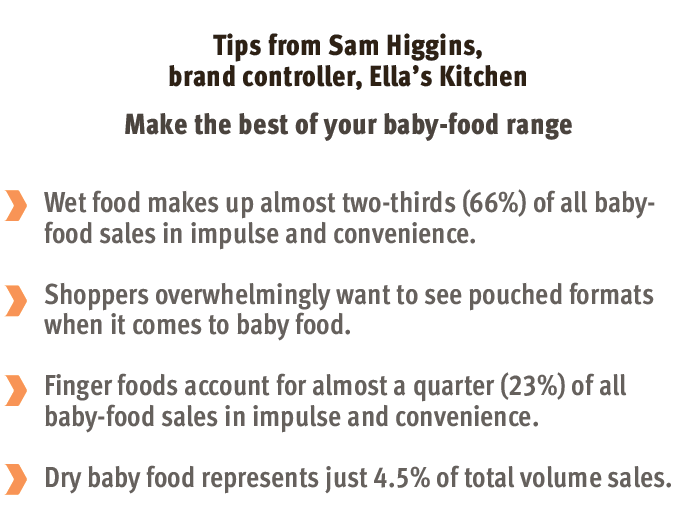

Baby-feeding sales have proved resilient in impulse and convenience for much of the past couple of years, as stay-at-home workers initially turned to local shops for many essential items, according to Sam Higgins, brand controller for Ella’s Kitchen at distributor RH Amar.

A gradual return to the physical workplace in the second half of 2021 – accompanied by brand consolidation within the baby-food category – has had strong recent growth for the category and Ella’s Kitchen, its bestselling brand, as time-strapped parents continue to turn to the category’s top sellers.

As a result, total sales of baby food are up by 4.6% in value year on year, while volume sales in impulse and convenience rose by 1.5% during the 12 weeks to the beginning of September. Ella’s Kitchen accounts for more than £1 out of every £3 spent on baby food across all retail channels. In impulse and convenience, where Ella’s market share is even greater (41.3%), the brand also accounts for the top five bestselling wet babyfood lines and returns significantly more value per distribution point than any other brand.

An evolving category

With shoppers visiting superstores less frequently during the pandemic, convenience stores’ role has had to evolve. Previously, says Matthew Goddard, sales director at Organix, shoppers used these outlets for impulse or top-up purchases, but they now provide more of a full range to fulfil parents’ regular needs.

Because of this, the demand for larger supermarket visits has decreased, so it’s important to provide a range of prices to maximise shopper reach and ensure there is something available to all consumers on different budgets. In bottled baby food, Vyas says his shoppers have moved from Cow & Gate and Heinz, which he’s cut down to three varieties of each, to pouches that are ready-made and easier for travelling. Desserts are still big sellers. The greatest change Vyas has seen since Covid-19, however, is new parents going for organic.

“We ask customers what they want, and organic baby food is the biggest request,” he says. “Working parents are very health-conscious when it comes to their babies, after spending time at home with them in the lockdowns. They realise they can buy organic, and it’s better value,” he says. If Vyas gets requests for new lines such as Farley’s Rusks Reduced Sugar, he stocks them. He used to sell powdered baby milks, but says its popularity has waned in favour of ready-made milk, which is more convenient. He adds: “Supermarkets sell [powdered milk], but nobody buys it, and they don’t buy baby food when it’s on offer. We offer products half price if they’re running short on date, but they don’t sell.”

Nappies are cleaning up

Nappies are doing particularly well at Limehurst, and Vyas sells a lot of larger packs. “The price isn’t important, it’s how many they get,” he says. He sells a lot of 10-12- packs as distress purchases. Vyas also tries to allocate more space to the new waterbased baby wipes.

He adds: “Parents go for biodegradable, or own label, depending on their budget.” Toiletries such as cotton buds and baby powder also sell steadily. DCS Group’s Stanton echoes Vyas’ perspective. “In the UK market as a whole, shoppers are buying larger packs of nappies,” Stanton says. “The fastest-growing pack size is ‘jumbo plus’, containing around 60-80 nappies, depending on nappy size.

“Shoppers in convenience stores are looking for smaller packs, with 94% of sales being ‘carry-pack’ sizes, which contain 17-30 nappies. Consumers respond to promotions, and Pampers Carry Packs are available as PMPs at £5.49.” Shoppers need to know a store stocks the right range, otherwise they will shop elsewhere. The range needs to be easy to fi nd in store and it also needs to be easy to access while pushing a pram or pushchair.

Comments

This article doesn't have any comments yet, be the first!