The soft drinks category remains a strong performer for retailers, fuelled by constant innovation, bold product launches and adventurous global flavour trends.

For those looking to stay ahead, keeping pace with emerging consumer interests is essential.

New flavours and global tastes in soft drinks

“Shoppers are seeking more variety from their soft drinks,” says Ash Chadha, sales and marketing director of Mogu Mogu. “They want bigger, bolder flavours and even new textures,” he adds.

Nishi Patel, of Londis Bexley Park in Dartford, Kent, believes that staying on top of trends is key to thriving in the category. He has successfully capitalised on pop-culture moments and social-media-driven crazes – sourcing Squid Game Energy Drinks at the height of the show’s global popularity and importing a Fresh Pistachio Dubai Chocolate drink following growing customer interest in the confectionery craze.

“We keep a selection of imported brands from Japan and America next to our international snacks to build incremental sales. We tend to keep an eye out for them on social media,” he explains.

Platforms such as TikTok and Instagram often act as early indicators of what consumers will want next, whether it’s a viral drink challenge or a new international flavour craze. Retailers who monitor these platforms and stay agile with their buying decisions can position themselves at the forefront of these trends.

Beyond pop culture, global flavour trends are also making their mark on the UK soft drinks market. Tropical fruit blends, Asian-inspired flavours like lychee and yuzu, and Middle Eastern influences such as rosewater and pistachio are increasingly popular among consumers.

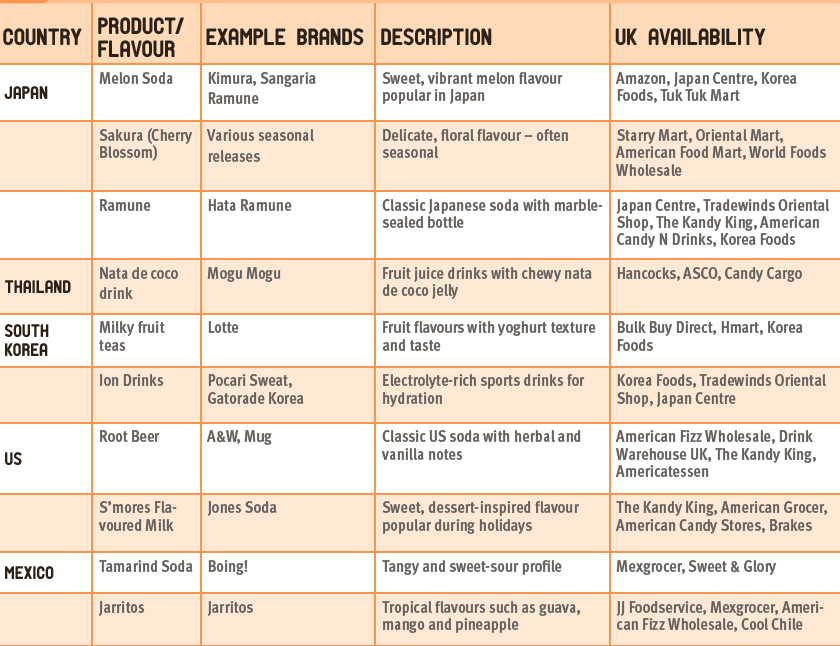

Know your global soft drinks

Health and wellness grow in importance

The health and wellness movement continues to reshape the category, with more consumers prioritising their well-being when choosing drinks.

Natalie Lightfoot, of Londis Solo Convenience in Baillieston, Glasgow, acknowledges the growing demand for sugar-free options. “Demand for sugar-free has risen over the past year,” she says.

This shift is reflected in broader consumer behaviour trends. According to a spokesperson from Red Bull, one in four shoppers now say that health and well-being is their number-one priority. “Seventy- five per cent of shoppers consider health when they choose a soft drink.

“Offering more no-sugar options is key to building incrementality for the category,” they added.

Retailers are responding to this shift by diversifying their soft drinks ranges to cater to health-conscious consumers. This includes increasing shelf space for sugar-free and reduced-calorie products, as well as highlighting functional benefits like added vitamins, electrolytes or natural ingredients.

How to promote sugar-free and low calorie options in soft drinks

Promoting these products effectively can significantly boost sales. Lightfoot notes that positioning healthier options at eye-level or near the checkout has helped encourage impulse buys from health-conscious customers.

Seasonal promotions and multi-buy offers on no-sugar options can also help drive trial and repeat purchases.

Functional drinks, such as vitamin-infused waters and natural energy drinks, are also gaining traction. Offering a selection of these alongside traditional soft drinks caters to a wider audience and can help boost overall category sales.

Moreover, retailers should consider using signage and labelling to highlight low-sugar and functional options clearly.

With clear in-store communication, customers are more likely to notice and choose healthier alternatives.

Striking the right balance on soft drink pack sizes

When it comes to pack sizes, it’s not a one-size-fits-all situation. Retailers should offer a diverse range of pack sizes to cater to various needs – whether it’s a quick grab-and-go can, a multipack for sharing or a larger take-home bottle.

For some retailers, shoppers are leaning toward smaller, on-the-go formats.

“Promotional activity always helps boost soft drinks sales. We have been shifting our focus to our smaller bottles and canned soft drinks as opposed to larger 2l formats,” explains Enya McAteer, from Mulkerns Spar in County Armagh.

This reflects a growing consumer preference for smaller, convenient formats – ideal for on-the-go shopper missions.

Communicating value in soft drinks

Price-marked packs (PMPs) continue to prove their worth in the soft drinks category.

“We dedicate a lot of space for larger bottled formats on the core brands like Coca-Cola and Sprite, and try to make sure we are offering PMPs,” says Ken Singh, of BB Nevison Superstore in Pontefract, West Yorkshire. “We make a 40-50% margin on the category,” he notes.

“Multipacks and larger formats are perceived to be better value due to their lower cost per litre. We predict that big bottles will translate to big business in 2025,” adds Mogu Mogu’s Chadha.

Comments

This article doesn't have any comments yet, be the first!