Leading on-demand grocery delivery firm Beelivery is to recruit 50,000 new drivers, creating new opportunities for local shops to generate extra sales, according the firm’s chief operating officer Paul Gott.

Unlike its rivals, Beelivery has no shops, no warehouses and no partnered outlets, just an army of delivery drivers which pick customer orders from whichever local store or supermarket is best placed to fulfil it.

While the firm doesn’t partner with stores, Gott told RN that small shop owners were already signing up as drivers so they could pick and deliver items from their own stores. He explained: “[shop owners signed up as drivers] get notified when there’s a customer wanting a delivery, they can accept that order and fulfil it from their store. Quite a few shop owners do that. We’re expecting in the next tranche of 50,000 drivers that quite a lot will be independent shops signing up.

“If they don’t have the resources to respond at that time they’re not penalised, another driver will just pick it up, it’s the best of both worlds.”

Unlike platforms such as Snappy Shopper and Uber Eats, there are no sign-up fees or commissions to be paid, and the driver gets paid for every order they complete. The only requirements are that drivers are registered as self-employed, own a smartphone and have a means of transport.

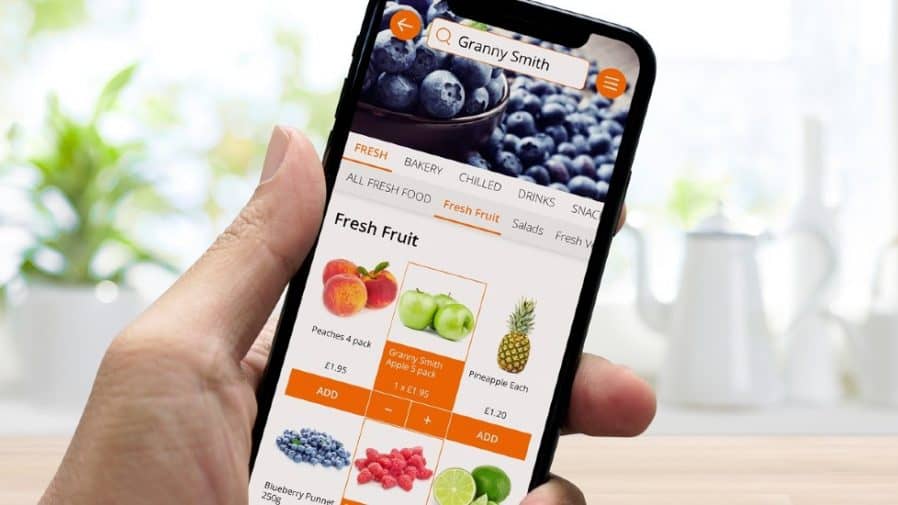

The service already covers 90% of UK households and is about to launch a £2m TV and online advertising campaign to boost its customer count. The services lists a range of 3,000 lines commonly found in convenience stores and supermarkets.

Gott also suggested the erosion of supermarket 24-hour opening policies due to the pandemic had created additional opportunities for local shops during peak early morning and late night ordering hours.

Describing Beelivery’s offer, the COO said: “When a customer orders, on average we’ll be on their doorstep 46 minutes later. You will have seen there are many London start-ups saying ‘aha! we can do 30 or 20minutes’ and they can – in one or two London postcodes. We’re doing 46 minutes across 90% of UK households with availability 24 hours a day, 365 days a year. That’s what makes us the leading on-demand service.”

As well as its recruitment drive, Paul Gott also revealed the firm is set to grow through acquiring a yet-unnamed rival. He said: “We’re just about to make our first acquisition and that’s going to be a theme coming up with delivery companies because none of them are making money and a few are starting to run out of cash.”

Gott also claimed that while the market for on-demand delivery is growing, the operating model of many delivery firms and major supermarkets is ‘flawed’ and ‘unprofitable’. Asked about the rising number of grocery delivery firms in the UK, he responded: “I don’t think it’s sustainable at all, even the big boys throwing hundreds of millions at it – that cash will run out, Tesco will reach a point where it doesn’t want to swallow the losses of deliveries anymore. At the end of the 90s you had the dot-com boom. There was someone who started selling books online that went on to dominate online retail, but there was a bigger business at the time – Webvan. They were a big American grocery delivery service which raised £800m at the end of the 90s and burnt through it in 18 months while trying to make a fundamentally flawed model work. Again we’re seeing billions invested into grocery delivery services, mostly in London. They call their sites ‘dark stores’ but only because nobody was going to invest millions in what is essentially a warehouse. It’s the same flawed model Webvan tried to make work.”

Outlining what makes Beelivery different, Gott told RN: “Our business model is like Ryan Air. We have a low cost business model with the lowest operating costs in the industry. They started with one plane and we started with one driver. They built their business model by arranging flights point to point whereas the incumbents were operating hub and spoke. For hub and spoke – think dark stores, think supermarket delivery. We are the point-to-point model for grocery delivery. Nobody is doing what we’re doing.”

Comments

This article doesn't have any comments yet, be the first!