National insurance cuts and a rise in tobacco duty were among the economic policies affecting independent retailers announced in this year’s Autumn Statement.

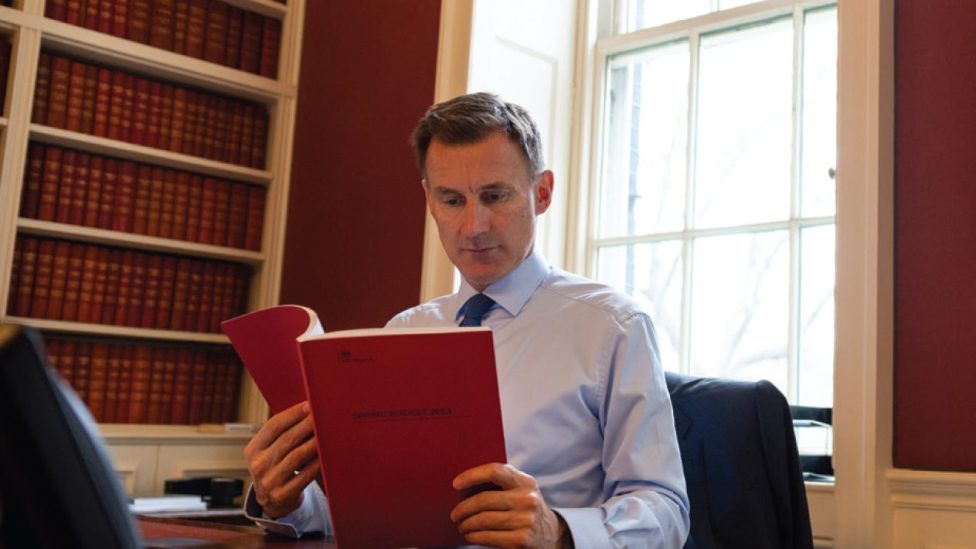

Speaking today, chancellor of the exchequer Jeremy Hunt confirmed he would be reducing national insurance from 12% to 10%, and that this would “urgently” come into force from 6 January 2024, so “people can see the benefits in their pay slips from the New Year”.

Those earning more than £12,570 a year will pay 12% on national insurance on earnings up to £50,200, while self-employed workers will pay 9%.

Hunt went further and abolished the Class 2 national insurance – which he revealed saves £192 for the self-employed. Class 4 national insurance will see a cut from 9% to 8% on earnings between £12,570 and £50,270.

Although Hunt confirmed alcohol duty will be frozen until August, duty on hand-rolling tobacco will increase by an additional 10% above the duty escalator.

Alongside this, he extended the 75% discount on business rates – the tax paid on non-domestic properties – up to £110,000 for firms in retail, hospitality and leisure for another year. Hunt confirmed all alcohol duty will now be frozen until August, resulting in no increase in duty on beer, cider, wine or spirits.

A further £500 million is also to be invested over the next two years to fund further “innovation centres”, in a bid to “make us an AI powerhouse”, claimed Hunt.

A “new, simplified” tax relief for research and development will combine the existing R&D Expenditure Credit and SME schemes. The full expensing scheme, due to expire in 2026, will now be made permanent.

This enables businesses to remove the entire cost of spending on new machinery and equipment, while also saving 25p from every pound pent on other types of investment.

Industry responses

The Fed revealed it is ‘disappointed’ with the lack of support towards energy bills and retail crime.

The Fed’s president Muntazir Dipoti said: “We are pleased that the chancellor has taken on board our serious concerns about business rates, but our members are still struggling with extortionate energy bills.

“Our costs are rising all the time, and when you factor in the increase in the minimum wage to £11.44 an hour, some small shops will inevitably have to consider whether their businesses are viable and sustainable.

“It was also disappointing that there was no mention of any increase in public spending, especially on policing, at a time when shoplifting and attacks on shop staff have reached epidemic proportions.”

Meanwhile, the ACS welcomed the extension of the 75% discount on business rates to help retailers with the “cost of trading during an extremely challenging time”, however there are fundamental issues for the sector that “need to be addressed”, according to ACS chief executive James Lowman.

He said: “Many of the smallest convenience stores who are already eligible for 100% rates relief so won’t see a material change from these announcements. Local retailers will be more concerned about how to absorb the cost of another significant jump in the national living wage rate, without any help to offset this huge increase in wage costs, such as reducing the burden of employer national insurance contributions.”

Read more politics news and articles for retailers

Comments

This article doesn't have any comments yet, be the first!