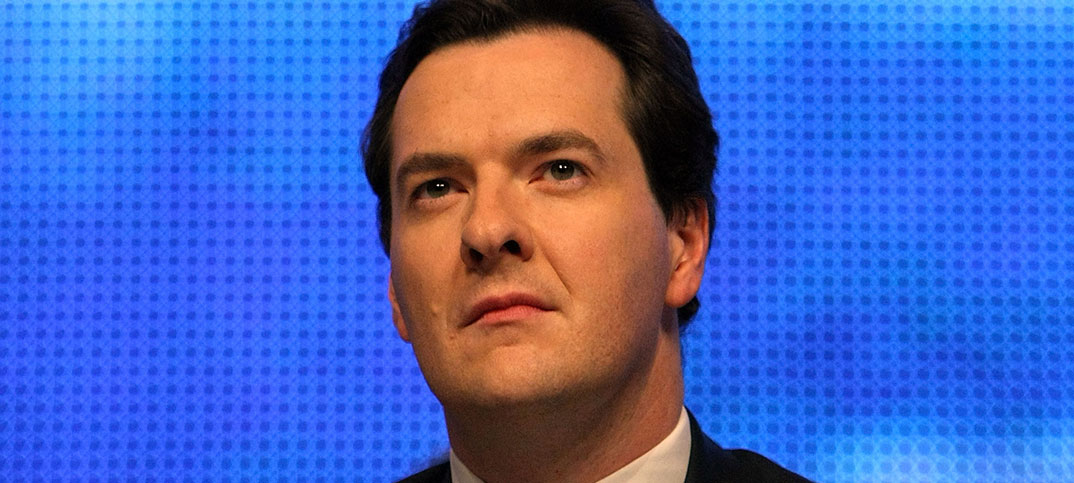

Today, George Osborne delivers his autumn statement.

For small businesses, it is one of the most important statements he, or any other chancellor, will have made.

Retail Express is joining the thousands of voices that have been clamouring for a complete overhaul of the outdated, ineffective and crippling business rates system. The whispers are that Osborne will tinker with the system but pressure is mounting from the industry for more radical change.

The ACS, NFRN, Federation of Small Businesses and British Property Federation are just a handful of organisations asking for the system to be made simpler and fairer to reduce

unmanageable bills for retailers – and for charges to be frozen while a review takes place.

ACS chief executive James Lowman said:

“It is time for Government to accept that it cannot increase the revenue it takes from businesses through property tax year after year without choking off the investment we need in our high streets.”

The FSB has warned that when rates relief reduces in March, 384,000 small businesses could be hit with charges they can’t afford. “In the short term we need to see relief measures for small business, and we would look to whoever forms the next Government to commit to fundamental reform of the system,” said FSB national chairman John Allan.

Regional publisher Johnston Press has also thrown its weight behind the issue, launching a campaign across its local newspapers last month. As Retail Express went to press, its ‘Save our high street’ petition already had the support of nearly 5,000 people.

“Small businesses are the lifeblood of their communities, and this campaign is aimed at helping them survive in an ever more challenging environment,” said Johnston Press chief executive Ashley Highfield.

Although Osborne has said he will review the system, many are not convinced he will go far enough. “The chancellor must be the only person in England who doesn’t think there should be a fundamental reform of business rates,” said business rates expert Paul Turner-Mitchell.

The message is clear… are you listening, George?

Business rates: the facts

- British property will be revalued on April 1. New payments take effect from 2017

- Business rates are set to bring in £27bn in the current financial year

- 78,714 property tax cases have been referred for a hearing since April

- Just 18,130 have been settled without the need for a ruling

- Award-winning independent retailer Sunder Sandher was overcharged by £4,844

Comments

This article doesn't have any comments yet, be the first!